Mastering Trading View: An In-Depth Guide to Enhancing Your Market Analysis Strategies

In today’s fast-paced financial markets, having access to reliable, comprehensive, and real-time trading tools is essential for traders and investors aiming to make informed decisions. One platform that has revolutionized the way market participants analyze and engage with various asset classes is trading view. Recognized globally, TradingView stands out as a supercharged charting and social networking platform that seamlessly combines advanced analytical tools with an interactive community. This article delves into the core features, setup procedures, advanced strategies, and community engagement tactics that make TradingView a vital resource for both novice and experienced traders alike.

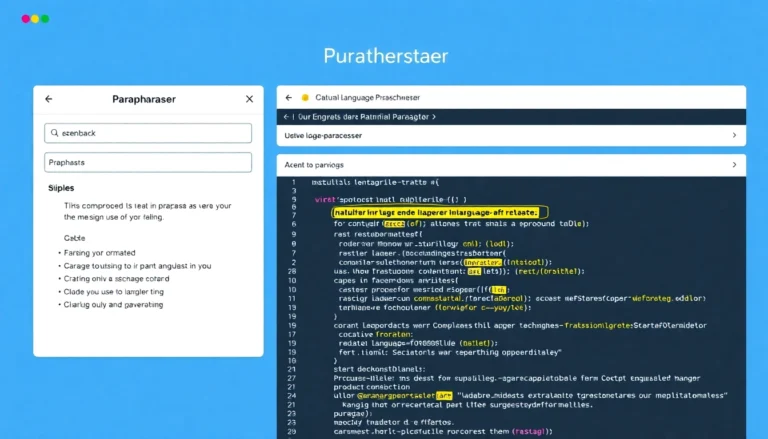

Understanding the Trading View Interface

At the heart of TradingView’s appeal is its intuitive yet sophisticated interface designed to cater to varied user needs. The platform features a customizable workspace that exhibits real-time market data, interactive charts, and social trading components. When you log into TradingView, you are greeted with a dashboard that aggregates market summaries and recent ideas from the community, giving traders immediate insight into current market sentiment.

The main components include:

- Charts: Highly customizable, supporting multiple chart types (candlestick, line, bar, Renko, etc.) and the ability to overlay numerous technical indicators and drawing tools.

- Watchlists: Allow quick access to selected assets, with options to create multiple lists tailored to different trading strategies or asset classes.

- Toolbar & Tools: Includes drawing tools like trendlines, Fibonacci retracements, and support for technical indicators such as RSI, MACD, Bollinger Bands, and more.

- Community & Ideas: Social features enable users to publish, comment on, and review trading ideas, fostering an educational and collaborative environment.

This seamless blend of analytical and social components makes TradingView not just a charting tool but a thriving community hub for market enthusiasts.

Benefits of Using Trading View for Traders and Investors

TradingView delivers numerous advantages that enhance trading effectiveness and decision-making. Among these are:

- Comprehensive Market Coverage: Real-time data spanning stocks, forex, cryptocurrencies, commodities, and indices ensure traders can analyze multiple asset classes within a single platform.

- Advanced Charting & Visualization: With over 100 native indicators and dynamic drawing tools, traders can identify patterns, support and resistance zones, and potential breakout points with precision.

- Customizability & Automation: Users can tailor their workspace to suit their trading style—creating templates, preset indicator combinations, and customized alerts for key price movements.

- Community & Social Trading: Access to trading ideas, strategies, and live discussions fosters learning and collaborative decision-making, essential components for developing a resilient trading mindset.

- Cross-Platform Accessibility: Available on desktop, web, and mobile applications, TradingView ensures traders maintain productivity regardless of location or device.

Additionally, the platform supports integration with numerous brokerage accounts, facilitating streamlined order execution directly from its charts, which minimizes latency and enhances trading efficiency.

Overview of Market Data and Charting Tools

Deep access to diverse market data coupled with powerful charting tools empowers traders to conduct detailed technical analyses. TradingView sources data directly from global exchanges, ensuring accuracy and timeliness.

Market Data Sources

TradingView aggregates data from a multitude of exchanges including NYSE, NASDAQ, CME, Binance, and more, providing extensive coverage of major financial instruments. Users can explore equities, forex pairs, cryptocurrencies, futures, and commodities, all in real time.

Charting and Technical Indicators

With hundreds of built-in indicators such as Moving Averages, RSI, MACD, Volume Profile, and custom scripts via Pine Script, traders can develop complex strategies or simply visualize fundamental price movements. The platform’s flexible design permits multi-timeframe analysis—allowing traders to cross-verify signals across different periods, from minutes to monthly charts.

Drawing and Annotation Tools

From trendlines and channels to Fibonacci retracements and Gann fans, trading view’s drawing tools enable precise marking of key levels, which can be saved and shared easily. This is especially useful for devising entry and exit points and communicating ideas within the trading community.

Getting Started with Trading View: Setup and Customization

Creating a Trading View Account

Starting with TradingView is straightforward. Sign up via the platform’s website or app and choose between free and premium plans. The free version offers ample features suitable for most beginners, while paid tiers unlock advanced indicators, multiple chart layouts, and real-time data options.

Customizing Charts and Watchlists for Optimal Use

Once logged in, traders should tailor their workspace. Creating multiple watchlists categorized by asset class or trading strategies facilitates quick access to relevant data. Customize charts by saving templates, adding preferred indicators, and setting default timeframes. This setup ensures a seamless analytical workflow tailored to individual preferences.

Integrating Trading View with Trading Platforms

TradingView supports integration with many brokers, allowing one-click trade execution directly from charts. This process involves linking your brokerage account, which can be done via account settings. This integration minimizes lag and simplifies order management, crucial for responsive trading.

Advanced Trading View Strategies for Better Market Analysis

Using Technical Indicators and Drawing Tools Effectively

Employ multiple indicators in conjunction—for example, combining RSI divergence with Fibonacci retracement—to confirm signals. Drawing tools help visualize breakout zones or trend deviations, offering a comprehensive market picture.

Implementing Trading Scripts and Alerts

TradingView’s Pine Script language allows creating custom indicators and automated alerts. For instance, setting alerts for specific crossover events or price levels enables timely decision-making without constant monitoring.

Analyzing Market Trends with Multiple Timeframes

Cross-timeframe analysis helps validate signals. For example, a bullish pattern on a daily chart confirmed by an hourly chart enhances confidence in a trade. TradingView allows easy multiframe analysis within a single workspace.

Leveraging Trading View Community and Social Features

Sharing and Reviewing Trading Ideas

Community sharing fosters learning; traders publish their strategies and analyses for feedback. Reviewing others’ ideas can uncover new insights or alternative approaches, broadening your analytical perspective.

Participating in Market Discussions

Engagement within forums or live chat rooms can provide real-time insights and support. Active participation enhances learning and helps traders stay updated on market sentiment and news.

Following Successful Traders and Analysts

By following experienced traders, you can gain insider tips, see their analysis, and adapt their methodologies. This social learning accelerates skill development and broadens your market understanding.

Performance Tracking and Optimization

Monitoring Your Trading Performance with Trading View

TradingView’s paper trading and strategy tester features allow backtesting strategies against historical data. Keeping track of performance metrics such as win rate, drawdowns, and risk-to-reward ratios guides continuous improvement.

Adjusting Strategies Based on Data Insights

Regular evaluation of trades and signals helps refine strategies. Use TradingView’s analytics tools to identify strengths and weaknesses, then personalize indicator settings or thresholds accordingly.

Staying Ahead with Continuous Learning and Updates

The platform frequently updates with new features and tools; staying informed through community channels and official updates ensures your analytical toolkit remains cutting-edge.